Please note that our office will be closed on Monday, August 5, 2024 for the Civic Day Holiday.

We will be happy to assist you when our office reopens on Tuesday, August 6, 2024 at 8:30am.

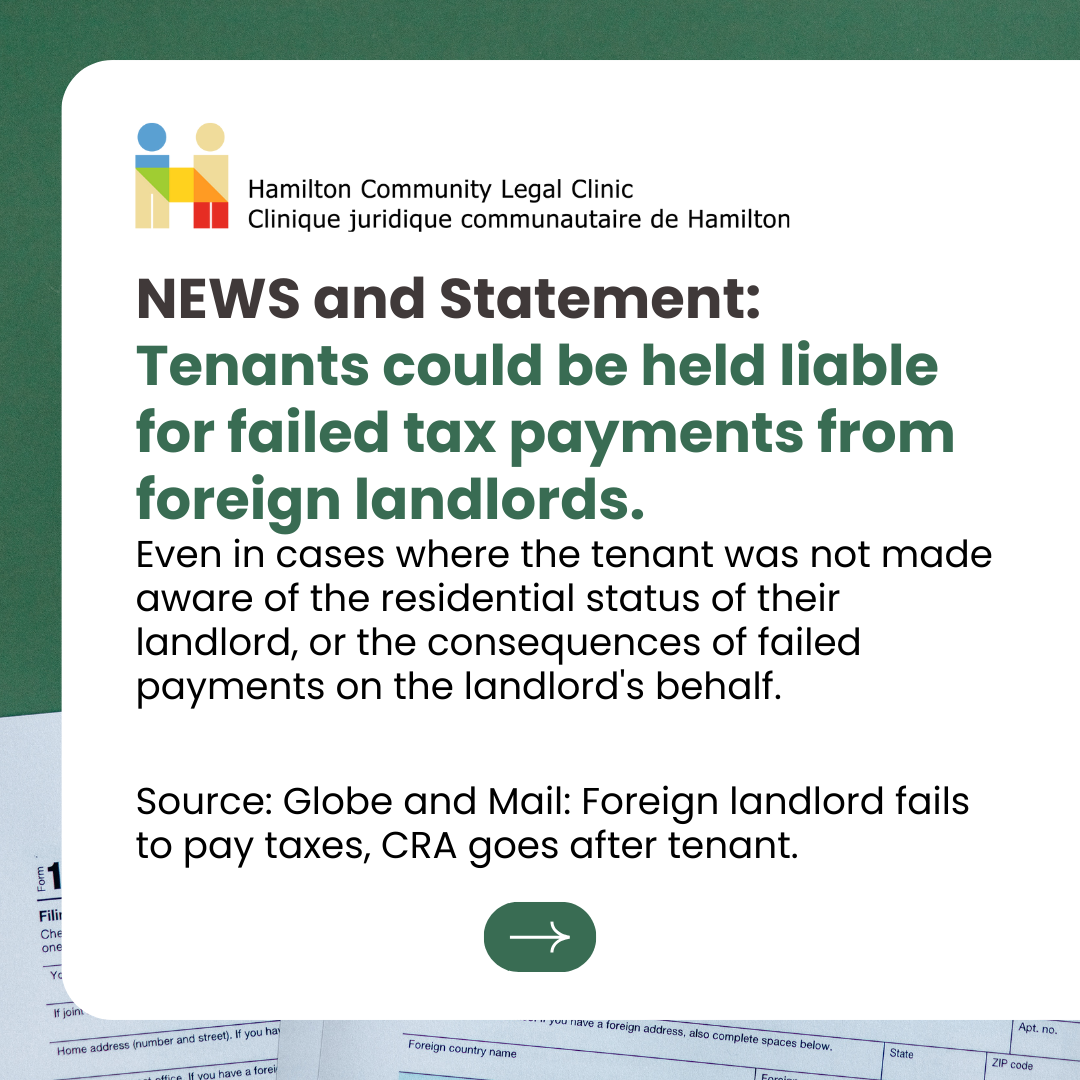

If your landlord is not a resident of Canada, the tenant has to pay 25% of the rent to the CRA. If they don’t, and if the landlord does not pay the required taxes, the tenant can be held liable with all of the interest and penalties.

Source: Foreign landlord fails to pay taxes, CRA goes after tenant. (Kerry Gold, The Globe and Mail Published April 12, 2024) https://www.theglobeandmail.com/real-estate/vancouver/article-foreign-landlord-fails-to-pay-taxes-cra-goes-after-tenant

The Hamilton Community Legal Clinic is deeply troubled by this decision. Shifting the burden of tax-collection onto renters demonstrates a stunning disregard for the protection of and well-being on Canadian tenants. The idea that a residential tenant ought to be in a position to determine their landlord’s tax obligations, if the landlord has met their tax obligations and then withhold rent accordingly, demonstrates a clear disconnection between the people writing and interpreting our laws and the real world in which Canadians live. We urge the Federal Government to quickly act to address this clear injustice.